Guide to common mistakes new traders make

The main reason that new traders make common mistakes is because of a lack of experience and knowledge. The list below highlights some of the basic mistakes new traders are prone to making. Hopefully, by understanding the mistakes, new traders will be able to avoid them and trade more successfully.

lack of trading experence leads to common mistakes

One of the main causes of basic errors in trading is inexperience. You can save money by using the free demo account that all trustworthy merchants provide. You may practice and acquire the experience required to trade successfully with free demo accounts. Therefore, before spending your hard-earned money, it is strongly advised that you practice on a demo account.

impatience and lack of traning

new traders are keen to jump straight into trading without the necessary understanding of how the forex market works One of the common mistakes new traders make is not getting knowledge of all aspects of forex trading. A comprehensive list of all aspects of Forex trading and alternative sources of knowledge can be found on the internet and I advise new traders to do extensive research before proceeding on their trading journey.

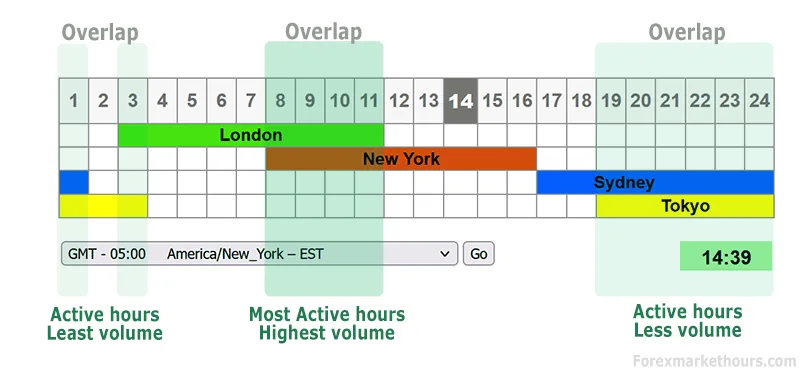

common mistakes:trading at the wrong times

Common mistake number two: most traders trade during the incorrect market session time. The markets are open 24/7 however only 20% of this time shows substantial movement. The best times to trade are during the trading hours in south africaas this is when the currencies are most volatile and of course, movement is necessary to create trading opportunities

Overtrading and poor risk management

Mistake number three: Overtrading and trying to catch up when you have lost. All traders will have losses at times and new traders need to accept this fact Professional traders advise that you should never trade with more than 2% of your capital on any one trade. Do not fall into the trap of increasing your trades in the hope of catching up on your losses

trading without a trading plane

Common mistake number four: Make a trading plan Before you start trading, you need rules for when you will enter trades and what time of day you will trade. You must identify the best trading times for your selected currency pairs and you must identify what trading strategy to follow.

Failing to act quickly in changing circumstances

The markets can change direction very quickly as they are influenced by a lot of factors. Breaking news and political events can have a big impact on the markets. Natural disasters that affect the country’s GDP can also affect the markets.

trading with emotion

Everybody has different emotions. Trading requires you to make emotional decisions. Stress and greed are typical feelings that frequently derail traders, particularly in the beginning. Trading using a single trading plan and adhering to its guidelines is the key to managing your emotions and making money. Every good trader has a plan, which helps them avoid making rash decisions.

trading with emotion

conclusion of common mistakes

in conclusion, everyone makes mistakes. The secret to success is to learn from your mistakes. Keep a daily trading journal listing why you failed or succeeded in your trade and refer to it regularly. This will serve to highlight your mistakes and help you avoid making them again