Introduction: Why Most Forex Traders Fail

Most new traders enter the forex market believing success comes from finding the perfect strategy. They search for the best indicator, the best entry signal, or the most accurate trading system. But over time, many discover a hard truth: strategy alone is not what keeps traders profitable.

The majority of trading accounts fail not because of bad entries, but because of poor risk control. Traders risk too much on a single idea. They use excessive leverage. They remove stop-losses when trades go against them. They try to recover losses quickly instead of staying disciplined.

Recovery Multiplier Tool

Powered by trybuying.com

Forex risk management is what separates traders who survive from those who disappear. It is not exciting. It does not promise instant profits. But it is the foundation of long-term success.

If you learn to control risk, you give yourself time to develop skill. Without risk control, even a good strategy will eventually destroy your account. This information was updated by Brian Rosemorgan, a retired professional forex trader in feb 2026

What Is Forex Risk Management?

Forex risk management is the structured process of protecting your trading capital by planning how much you are willing to lose before you enter a trade. It ensures that no single trade — or even a series of trades — can significantly damage your account.

Every trade involves uncertainty. No trader can predict the market with 100% accuracy. Risk management accepts this uncertainty and builds rules around it. Instead of focusing only on potential profit, you define acceptable loss first.

Effective forex risk management revolves around five key areas: how much you risk per trade, where you place your stop-loss, how large your position size is, how much leverage you use, and how well you manage your emotions. When these elements are aligned, your trading becomes structured instead of impulsive.

Risk management shifts your mindset from “How much can I make?” to “How much can I safely risk?” That shift alone changes everything.

Types of Forex Risk Every Trader Must Understand

Understanding risk means recognizing that losses do not come from one source. The forex market exposes traders to different types of risk, each affecting trades in different ways.

Market Risk (Price Movement Unpredictability)

Market risk is the possibility that price moves against your position because of normal market fluctuations. Currency prices respond constantly to economic data, geopolitical developments, central bank statements, and overall market sentiment.

Even if your technical analysis is sound, unexpected news can cause sharp reversals. A surprise inflation report or political announcement can invalidate a setup within minutes. This unpredictability is part of trading.

Market risk cannot be removed. It can only be managed through proper stop-loss placement, controlled position sizing, and realistic expectations. Accepting that price movement is uncertain is the first step toward responsible trading.

Leverage Risk (Amplified Losses)

Leverage allows traders to control large positions with relatively small capital. While this increases potential profits, it also magnifies losses.

For example, using high leverage means that a small percentage move against your position can result in a disproportionately large loss. Many beginners underestimate how quickly leveraged positions can erode capital.

Leverage itself is not dangerous — misuse of leverage is. When traders focus on maximizing position size instead of controlling percentage risk, volatility increases dramatically. Conservative leverage use keeps equity swings manageable and reduces emotional pressure.

Liquidity Risk

Liquidity refers to how easily a currency pair can be bought or sold without significantly affecting its price. Major currency pairs generally have high liquidity, meaning trades are executed quickly with tight spreads.

However, during low-volume trading hours, holidays, or major news events, liquidity can decline. When liquidity drops, spreads widen and slippage becomes more common. This means your trade may be executed at a worse price than expected.

Understanding liquidity conditions helps traders avoid unnecessary transaction costs and unpredictable execution.

Interest Rate Risk

Interest rates are one of the strongest drivers of currency value. Central banks adjust rates to manage inflation and economic growth, and currency markets respond quickly to those decisions.

If a central bank unexpectedly raises or lowers interest rates, volatility can increase sharply. Traders holding positions during such announcements may experience rapid price movements.

Monitoring economic calendars and being aware of scheduled rate decisions reduces exposure to sudden volatility. Interest rate shifts often influence long-term trends as well as short-term spikes.

The Core Risk Management Rules Every Trader Should Follow

Once you understand the types of risk, the next step is applying practical rules that protect your capital.

Risk Only 1–2% Per Trade

Limiting risk per trade is one of the most important principles in trading. Risking a small percentage of your account ensures that even during losing streaks, your capital remains intact.

If you have a $1,000 account and risk 1% per trade, your maximum loss is $10. Even ten consecutive losses would not destroy your account. This controlled exposure gives you the resilience needed to continue trading and improving.

Large percentage risks may produce faster gains during winning streaks, but they also create devastating drawdowns during losing periods. Small risk builds sustainability.

Always Use a Stop-Loss

A stop-loss defines the point at which your trade idea is invalidated. It protects you from holding losing positions indefinitely.

Stop-loss placement should be logical and based on market structure. It should sit beyond a level that, if broken, proves your analysis incorrect. Once placed, it should not be moved to avoid accepting a loss.

Using stop-loss orders consistently creates a predictable risk profile for your trading.

Slippage and Gapping: The Hidden Risks

Even with a perfect trading plan, market conditions can prevent your orders from being executed at your exact desired price. This is where slippage and gapping come into play.

What is Slippage?

Slippage occurs when there is a difference between the price you requested and the price at which the trade was actually executed. This usually happens during periods of high volatility (like news releases) or low liquidity (when there aren’t enough buyers or sellers at your price level).

- Positive Slippage: Your trade is filled at a better price than requested.

- Negative Slippage: Your trade is filled at a worse price than requested.

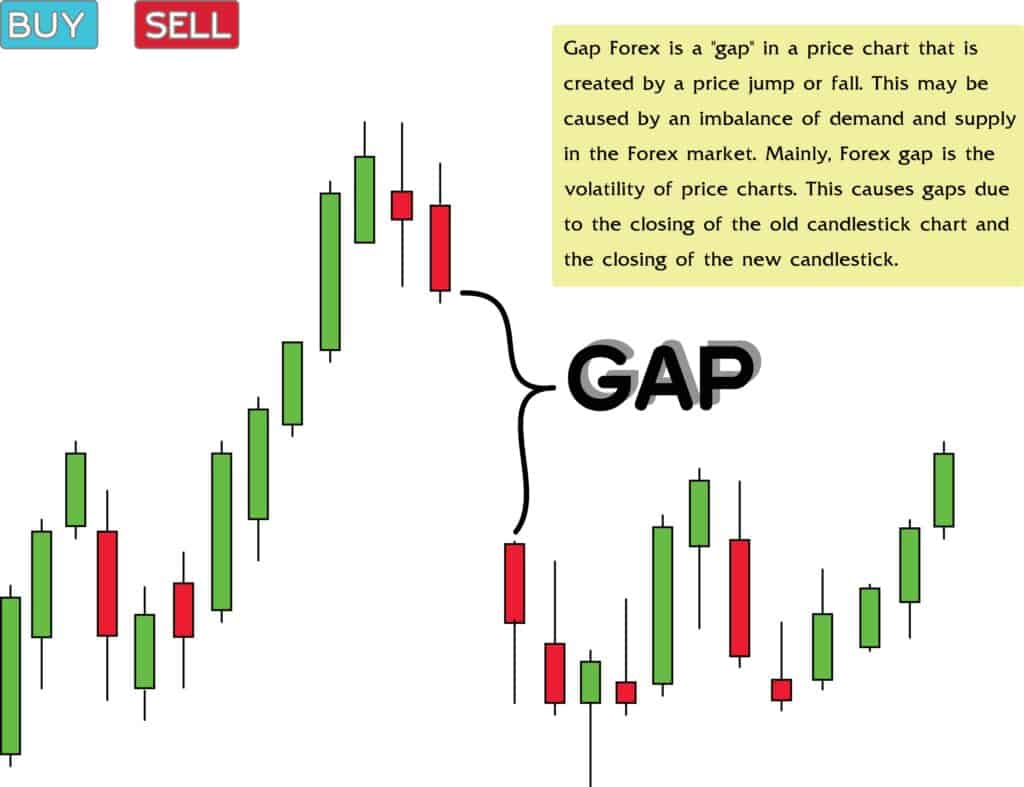

What is Gapping?

Gapping occurs when a currency pair’s price jumps from one level to another without any trading happening in between. In Forex, this most frequently happens over the weekend when the market is closed, but major global events can cause “price gaps” during the trading week as well.

Calculate Position Size Correctly

Position size must match your risk percentage and stop-loss distance. If your stop-loss is wide, your position must be smaller. If your stop-loss is tight, your position can be slightly larger — but always within your predefined risk percentage.

This ensures that every trade carries similar financial exposure, regardless of setup differences. Consistency in position sizing creates consistency in results.

Maintain a Positive Risk-Reward Ratio

Risk-reward ratio measures how much you aim to gain compared to how much you risk. A ratio of 1:2 means you aim to gain twice what you risk.

Even if you win fewer than half of your trades, a strong risk-reward structure can still produce profitability over time. This mathematical edge reduces pressure to achieve a high win rate.

How to Calculate Risk Per Trade: A Practical Example

Understanding risk conceptually is helpful, but applying it numerically is what builds confidence.

Suppose your account balance is $2,000 and you decide to risk 1% on a trade. That equals $20.

You identify a setup where your stop-loss must be 40 pips away from entry. To ensure your maximum loss remains $20, you calculate a position size where a 40-pip loss equals $20.

By working backwards from your acceptable loss, you determine the correct lot size rather than guessing. This method keeps risk precise and controlled.

The key principle is simple: define risk first, then calculate size.

Risk Management Tools That Improve Discipline

Modern trading platforms provide tools that simplify risk control. Position size calculators help determine correct lot sizes. Economic calendars alert traders to upcoming high-impact events. Trading journals allow you to review performance and identify patterns in risk behavior.

Using tools reduces emotional decision-making. Instead of estimating or reacting impulsively, you follow a structured process.

Consistency builds confidence.

Common Risk Management Mistakes

Many accounts fail because traders ignore simple rules. Risking large percentages to “grow faster,” removing stop-losses to avoid taking losses, overleveraging positions, and increasing lot sizes after losses are common destructive behaviors.

Another frequent mistake is overtrading — entering too many positions without high-quality setups. Each trade carries risk, and excessive exposure increases the probability of large drawdowns.

Recognizing these patterns early can prevent long-term damage.

The Psychological Side of Risk Management

Risk management is not just about numbers. It is about emotional stability.

Losses are inevitable. What matters is how you respond to them. Traders who abandon their risk rules after a losing streak often compound their losses. Those who stay disciplined preserve capital.

Emotional control means accepting small losses as part of the process. It means trusting your predefined rules rather than reacting to short-term market noise.

Professional traders focus on executing their plan consistently. They understand that long-term profitability comes from disciplined repetition, not emotional reactions.

Should You Practice Risk Management on a Demo Account?

Before risking real money, practicing risk management on a demo account allows you to refine your approach without financial pressure.

You can test different stop-loss placements, position sizing calculations, and risk percentages. You can track drawdowns and assess how your strategy performs over time.

Once consistency is achieved in a simulated environment, transitioning to live trading becomes far less stressful.

Final Thoughts: Risk First, Profit Second

Forex trading is not about avoiding losses. It is about controlling them.

Every successful trader understands that losses are part of the journey. What determines long-term survival is how well those losses are managed.

If you prioritize risk management above profit, you create a stable foundation. From that foundation, skill and experience can grow.

Protect your capital first. Growth follows discipline.

“Forex Drawdown Recovery Table

The Mathematical Reality of Trading Losses

This table shows how much profit you need just to get back to breakeven after a series of losses. Notice how the “Profit Required” grows exponentially as your “Capital Loss” increases.

| Capital Loss (%) | Profit Required to Break Even (%) | Difficulty Level |

| 5% | 5.3% | Easy |

| 10% | 11.1% | Manageable |

| 20% | 25% | Moderate |

| 30% | 42.9% | Difficult |

| 40% | 66.7% | Very Hard |

| 50% | 100% | Extreme |

| 75% | 300% | Near Impossible |

| 90% | 900% | Game Over |

Using AI Sentiment Analysis to Avoid Slippage

In 2026, many traders have moved beyond just watching the economic calendar. They now use AI-driven Sentiment Analysis to predict when “toxic” volatility is likely to occur.

How AI Sentiment Tools Work

Unlike a human who can only read one news story at a time, AI algorithms (using Natural Language Processing) scan millions of data points per second, including:

- Real-time news wires (Reuters, Bloomberg).

- Central bank “Fed-speak” and subtle shifts in policy tone.

- Financial chatter on social media platforms and trader forums.

Predicting Slippage Before It Happens

AI tools assign a “Sentiment Score” to currency pairs. If the AI detects an extreme “Fear” spike or a massive “Divergence” between news sentiment and price action, it acts as an early warning system.

- The Early Warning: A sudden spike in negative sentiment 15 minutes before a news release often signals a “liquidity vacuum.”

- The Action: Advanced traders use this data to lower their leverage or widen their stop-losses to account for the high probability of slippage and gapping.

2026 Pro Tip: Tools like Acuity Trading or MarketMind AI can now be integrated directly into platforms like MetaTrader 5, providing real-time “volatility alerts” based on AI-filtered news flows.

“Many beginner traders don’t realize that losses are not linear; they are exponential. If you lose 50% of your account, you don’t just need a 50% gain to get back to where you started—you need to double your money (100% gain) just to break even. This is why strict risk management is the only way to survive in the long term.”